Services

As both an adviser and broker, we procure capital for investment properties located in the United States and provide post-closing financial reporting services for our clients’ assets under management.

Capital Placement

Our primary business is the arrangement and negotiation of healthy debt via the origination of commercial mortgages by creating, facilitating, and strengthening relationships with:

- Local, regional, and national banks

- The Agencies (Fannie/Freddie/FHA) and their originators

- CMBS (securitizing) institutions

- Credit unions

- Insurance companies and pension funds

- Private lenders

We also arrange equity for owners and developers who, in order to complete a project’s capital stack and to leverage their own cash-on-cash returns, seek funding from institutional investors interested in partnering on either a passive or more active basis.

Asset Management

Post-closing, many lenders require annual, semi-annual, or even monthly financial reporting that allows them to track their collateral’s performance. Requisite documentation, for example, often includes:

- Rent Rolls

- Year-to-date (Trailing) Operating Statements

- Balance Sheets

- Personal Financial Statements

- Business and Personal Tax Returns

- Service Agreements

We offer this tracking and processing service on an ongoing basis to existing clients. Borrowers find it particularly helpful from an administrative point of view and as good preparation for future financing events.

About Us

Americana Financing is a consulting and brokerage firm with two main real estate service lines: commercial mortgage placement and asset management. We have negotiated and customized debt packages for a wide variety of investment property types located in the NYC metro area (Manhattan, Brooklyn, & Queens and Nassau, Westchester, & Fairfield counties), Los Angeles, South Florida, and North Carolina and are equipped to arrange capital for investment properties across the country.

Whether our client is a multi-generational family office seeking expansion of their portfolio by acquiring a new apartment building, a local restauranteur looking to buy the retail property that houses her establishment, or a more institutional client in need of financing to purchase multiple triple-net assets, we take pride in the experience, expertise, and patience that we bring to all of our relationships and every transaction.

Our senior broker, Douglas Chitel, has 18+ years of commercial real estate experience, including tenures with Marcus & Millichap, Winter & Company, and Nancy Packes. He holds a B.A. from Tufts University and an M.S. from New York University.

Douglas Chitel

Testimonials

Loan Options

Acquisition or

Refinancing

Acquisitions often elicit higher leverage than refinancings, which are generally classified as a.) rate & term focused on improving the existing interest rate and resetting the loan term with no net cash gain and b.) cash-out used to pull equity out of a property via a “take-home check” to the borrower at closing.

Permanent

Bridge

Mezzanine

A high-leverage mortgage product used to limit cash injection and, subsequently, positively leverage debt (up to 85-90%+ of as-stabilized appraised value) and maximize cash-on-cash returns. It is generally a subordinate/junior loan.

Construction / Rehabilitation:

Debt financing utilized for ground-up construction and major property rehabilitations. Generally utilized in the form of a draw over time but sometimes released in one lump sum. Interest only payments at first and can often convert into a permanent mortgage with amortization.

Equity

“Preferred” equity may be considered debt, as it requires a fixed rate of return and is still senior to investors’ and sponsors’ positions. “Common/JV” equity sources from cash investors who accept a comparable risk level as the sponsor and who act as an active general partner (GP) or more passive limited partner (LP).

Property Types

Multifamily

- Apartment buildings and complexes with 5+ units

- Student and Senior Housing

- Affordable Housing

Mixed-use

- Generally multifamily use plus retail or office use

- May include community facility space for greater floor area ratio (FAR)

- Popular among urban planners seeking to promote 24/7 lifestyles

Retail and SBA

- Shopping malls, strip centers, and big boxes

- Double- or triple-net (NNN) assets where tenant covers most of the expenses

- Owner-occupied establishments qualifying for SBA 504 or 7(a) products

Industrial/Storage

- Warehouse and self-storage buildings

- Dry and wet manufacturing facilities

- Logistics and distribution centers along all levels of the supply chain

Hospitality

- Full or limited-service hotels

- Amusement and theme parks

- Spas and resorts

Office

- Professional space for law firms, tech companies, investment banks, etc.

- Medical space for doctors, dentists, and other health care professionals

- Commercial Condominiums

Single-Family Portfolios

- Pools of 5+ non owner-occupied existing or proposed homes known as:

- Single-Family Rentals (SFRs)

- Build-to-Rent (BTRs)

Land, Special Purpose, and Other

- Vacant Land

- Golf courses and marinas

- Summer camps and country clubs

Sample Closings

Winston-Salem, NC - Retail

Project Type:

Loan Type:

Loan Amount:

Story:

Retail

Bridge-to-Perm Acquisition

$4,500,000

Buyer saw upside to owning this asset that would also house his retail business in a growing Southeast submarket; Significant vacancy at closing, so acquisition lender held back reserves for forthcoming tenant improvements and leasing commissions, which released later as needed and upon provided invoices or receipts.

Project Type:

Retail

Loan Type:

Bridge-to-Perm Acquisition

Loan Amount:

$4,500,000

Story:

Buyer saw upside to owning asset that would also house his retail business in a growing Southeast submarket; Significant vacancy at closing, and acquisition lender held back reserves for forthcoming tenant improvements and leasing commissions, which released later as needed and upon provided invoices or receipts.

Santa Monica, CA - Mixed-use

Project Type:

Loan Type:

Loan Amount:

Story:

Mixed-use (Office/Retail)

Permanent Refinancing

$10,750,000

Fully occupied retail property in prime L.A. submarket; loan blanketed with another non-adjacent property in nearby neighborhood.

Project Type:

Mixed-use (Office/Retail)

Loan Type:

Permanent Refinancing

Loan Amount:

$10,750,000

Story:

Fully occupied retail property in prime L.A. submarket; loan blanketed with another non-adjacent property in nearby neighborhood.

Delray Beach, FL - Investment Condominium

Project Type:

Loan Type:

Loan Amount:

Story:

Investment Condominium

Acquisition

$627,750

Quick purchase of a residential condominium for investment purposes in prime South Florida submarket directly along the Intracoastal Waterway.

Project Type:

Investment Condominium

Loan Type:

Acquisition

Loan Amount:

$627,750

Story:

Quick purchase of a residential condominium for investment purposes in prime South Florida submarket directly along the Intracoastal Waterway.

East Williamsburg, NYC - Mixed-use

Project Type:

Loan Type:

Loan Amount:

Story:

Mixed-use (Multifamily/Retail)

Permanent Refinancing/Bridge/Permanent

$5,400,000

Financed multiple times by Americana: first while waiting for occupancy in the asset’s ground floor to stabilize and then again when the property was fully occupied and cash-flowing in a booming Brooklyn submarket.

Project Type:

Mixed-use (Multifamily/Retail)

Loan Type:

Acquisition/Bridge/Permanent

Loan Amount:

$5,400,000

Story:

Financed multiple times by Americana – first waiting for occupancy in the asset’s ground floor to stabilize and then again when the property was fully occupied and cash-flowing in a booming Brooklyn submarket.

East Harlem, NYC - Mixed-use

Project Type:

Loan Type:

Loan Amount:

Story:

Mixed-use (Multifamily/Retail)

Refinancing

$1,350,000

Partially owner-occupied asset refinanced after a gut renovation in order to extract cash/equity out of the property and to lower the interest rate.

Project Type:

Mixed-use (Multifamily/Retail)

Loan Type:

Refinancing

Loan Amount:

$1,350,000

Story:

Partially owner-occupied asset refinanced after a gut renovation in order to extract cash/equity out of the property and to lower the interest rate.

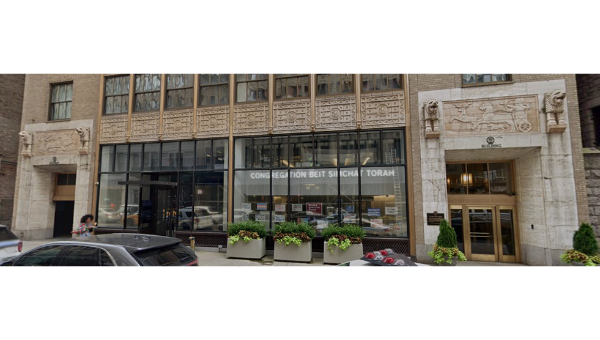

Midtown South, NYC - Retail Condominiums

Project Type:

Loan Type:

Loan + Sales Amount:

Story:

Commercial/Retail Condos

Acquisition

$10,750,000

We served as this non-profit buyer’s sales and financing agent by locating the asset, negotiating the purchase terms, and procuring the commercial mortgage that allowed the congregation to acquire two adjacent retail condominiums in this Cass Gilbert property.

Project Type:

Commercial/Retail Condos

Loan Type:

Acquisition

Loan + Sales Amount:

$10,750,000

Story:

We served as this non-profit buyer’s sales and financing agent by locating the asset, negotiating the purchase terms, and procuring the commercial mortgage that allowed the congregation to acquire two adjacent retail condominiums in this Cass Gilbert property.

North Williamsburg NYC - Retail

Project Type:

Loan Type:

Loan Amount:

Story:

Triple-Net Retail

SBA Refinancing

$3,485,000

3,500 square foot single-tenant restaurant operator took advantage of high leverage (85-90% LTV) financing that SBA 7(a) and 504 loans provide.

Project Type:

Triple-Net Retail

Loan Type:

SBA Refinancing

Loan Amount:

$3,485,000

Story:

3,500 square foot single-tenant restaurant operator took advantage of high leverage (85-90% LTV) financing that SBA 7(a) and 504 loans provide.

Venice, CA - Mixed-use

Project Type:

Loan Type:

Loan Amount:

Story:

Mixed-use (Single-Family/Office)

Acquisition

$10,750,000

Buyer purchased this celebrity-owned home in an oceanfront L.A. neighborhood and then maintained residence in the asset for a period of time and leased out the large retail space to a well-known tech firm. Financing involved using the cross-collateralizing strength and stability another nearby retail asset.

Project Type:

Mixed-use (Single-Family/Office)

Loan Type:

Acquisition

Loan Amount:

$10,750,000

Story:

Buyer purchased this celebrity-owned home in an oceanfront L.A. neighborhood and then maintained residence in the asset for a period of time and leased out the large retail space to a well-known tech firm. Financing involved using the cross-collateralizing strength and stability another nearby retail asset.

Upper West Side, NYC - Multifamily

Project Type:

Loan Type:

Loan Amount:

Story:

Mixed-use (Multifamily/Retail)

Refinancing

$14,200,000

We serviced this 13,000 SF property along a prime Upper West Side thoroughfare by arranging two permanent loans over the course of three years. Both mortgages took advantage of a decreasing interest rate environment, provided significant cash-out, and included a blanket with multiple other properties.

Project Type:

Mixed-use (Multifamily/Retail)

Loan Type:

Refinancing

Loan Amount:

$14,200,000

Story:

We serviced this 13,000 SF property along a prime Upper West Side thoroughfare by arranging two permanent loans over the course of three years. Both mortgages took advantage of a decreasing interest rate environment, provided significant cash-out, and included a blanket with multiple other properties.

Stamford, CT - Multifamily

Project Type:

Loan Type:

Loan Amount:

Story:

Multifamily

Acquisition

$2,000,000

Borrowers bought this property using an Agency-backed mortgage in order to expand their portfolio with this mostly occupied building in the most reliable asset class.

Project Type:

Multifamily

Loan Type:

Acquisition

Loan Amount:

$2,000,000

Story:

Borrowers bought this property, using an Agency-backed mortgage, to expand their portfolio with this mostly occupied building of the most reliable asset class.

Upper West Side, NYC - Multifamily

Project Type:

Loan Type:

Loan Amount:

Story:

Multifamily

Refinancing

$14,200,000

Prime Upper West Side building of apartments only, situated mid-block just feet from Central Park; refinanced twice and served as ultra-stable collateral in a blanket mortgage covering multiple Manhattan assets.

Project Type:

Multifamily

Loan Type:

Refinancing

Loan Amount:

$14,200,000

Story:

Prime Upper West Side building of only apartments, situated mid-block just feet from Central Park, refinanced twice and served as ultra-stable collateral in a blanket mortgage covering multiple Manhattan assets.

Roslyn, Long Island, NY - Mixed-use

Project Type:

Loan Type:

Loan Amount:

Story:

Mixed-use (Multifamily/Office)

Bridge-to-Perm Refinancing

$4,200,000

Bridge loan took out more expensive hard money acquisition loan so that the borrower could lower their interest rate significantly and buy more time (less expensively) to stabilize the property with physical occupancy by a new ground floor retail tenant.

Project Type:

Mixed-use (Multifamily/Office)

Loan Type:

Bridge-to-Perm Refinancing

Loan Amount:

$4,200,000

Story:

Bridge loan took out more expensive hard money acquisition loan so that the borrower could lower his interest rate significantly and buy more time (less expensively) to stabilize the property with physical occupancy by a new ground floor retail tenant.

Park Slope, NYC - Condo Conversion

Project Type:

Loan Type:

Loan Amount:

Story:

Condominium Conversion

New Construction/Rehabilitation

$1,700,000

Owners used the loan proceeds to complete a major gut renovation of this prime-Park Slope multifamily brownstone, including the addition of an extra floor and the conversion of multiple rental units into two luxury residential condominiums.

Project Type:

Condominium Conversion

Loan Type:

New Construction/Rehabilitation

Loan Amount:

$1,700,000

Story:

Owners used the loan proceeds to complete a major gut renovation of this prime-Park Slope multifamily brownstone, including the addition of an extra floor, to convert multiple rental units into two luxury residential condominiums.

Upper West Side, NYC - Multifamily

Project Type:

Loan Type:

Loan Amount:

Story:

Multifamily

Refinancing

$14,200,000

Sponsor refinanced this prime-located apartment building near Lincoln Center as part of a blanket mortgage for two major cash-out refinancing events just three years apart.

Project Type:

Multifamily

Loan Type:

Refinancing

Loan Amount:

$14,200,000

Story:

Sponsor refinanced this prime-located apartment building near Lincoln Center as part of a blanket mortgage for two major cash-out refinancings just three years apart.